How to Calculate Cost Price?

SADC and CAE Expert Advice

That’s it! You have made the decision to go into business for yourself and live your passion. You have found a catchy name for your small business, designed a logo, completed a market study and developed a marketing plan… Or do you simply have the wind in your sails and are preparing to develop new products?

Now you’re at the stage of pricing your products. How do you go about it? The first step is to accurately calculate your costs.

What is Cost Price?

The cost price represents all the direct and indirect expenses that your company will incur to manufacture a product or offer a service, as well as the profit margin. It allows you to determine the gross margin and to establish a selling price.

The cost price includes:

- Production costs

These include all the costs necessary for production: the cost of purchasing raw materials, staff salaries, the quota-share of depreciation linked to production, as well as other variable and fixed costs that may apply, such as rent, electricity consumption, etc. - Production purchase costs

These relate to the supplies used during production: delivery costs, customs duties, etc. - The cost of product and service distribution

These are all the costs linked to the marketing of the product or service: advertising costs, transportation costs to the point of sale, packaging costs, etc. - The administrative costs of producing a product or service

These are the costs related to the support and administrative functions of the company (after-sales service, general services): the salaries of the management teams, the accounting department, etc., the quota-share of depreciation of the equipment used by these services.

Why is it so important to determine the cost price?

Regardless of the size of your company or your sector of activity, calculating the cost price is a fundamental tool for setting the selling price of your goods or services. Once determined, you can try to reduce it as much as possible, in order to increase your profit margins. It is an essential tool for your business plan, one that gives you a head start when it comes time to apply for financing.

How to calculate the cost price?

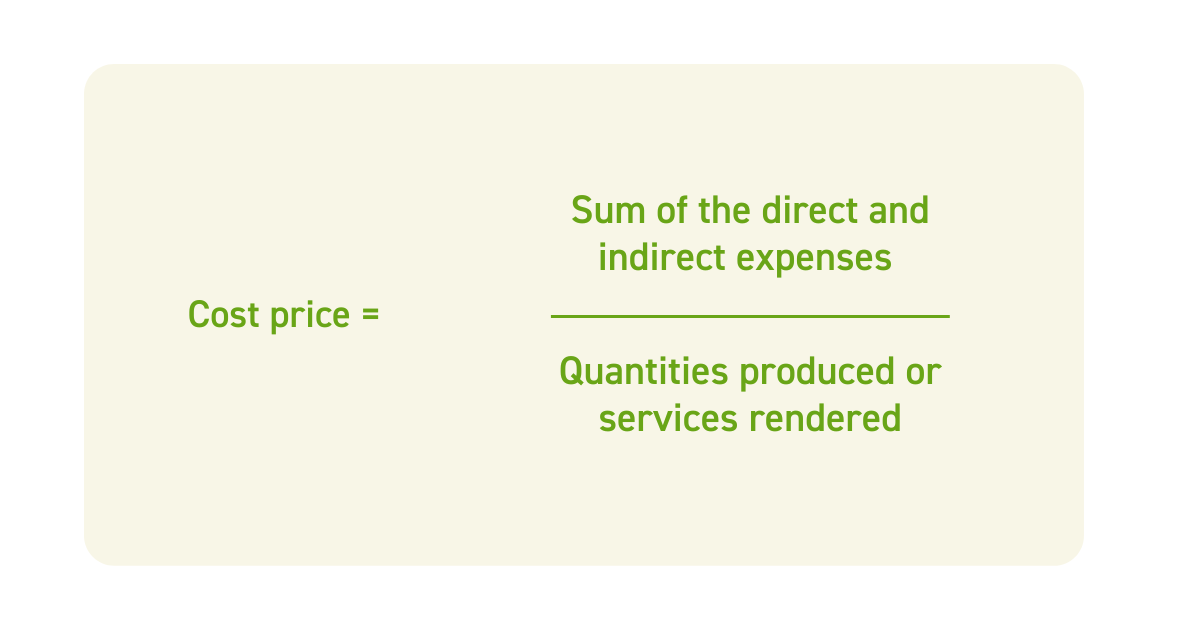

The calculation of the cost is done according to the direct and indirect expenses of your company. It must be determined for each product or service you offer. It is calculated by adding the direct and indirect expenses, then dividing the sum obtained by the quantity of goods produced or services rendered.

Calculation example

Let’s take the example of Julie, owner of a woodworking shop. For her first year in business, she has decided to offer only tables.

If the direct expenses to produce 100 tables are $25,000 and the indirect expenses are $40,000, the cost of production will be calculated as follows:

(25 000$+ 40,000$) / 100 = 650$

The cost of Julie’s tables is $650.

This calculation allows Julie to know the unit cost of her tables, and to set the selling price so that her business can break even. Julie will then have to determine the amount of margin that will allow her to make a profit from the sale of her tables.

If Julie wants to offer other products to her customers, such as chairs, she will need to allocate her business costs to her tables and chairs to determine the cost of each product.

Are you ready to determine the cost of your products or services?

The advisors at your local SADC and CAE are there to support you in this crucial step, to help contribute to the profitability of your business. They will help you demystify each step and make the process of determining the cost price simple, or almost!

Ready, set, go!

Your local SADC and CAE advisors are here to help you go further.